Understanding Supply and Demand in the Stock Market

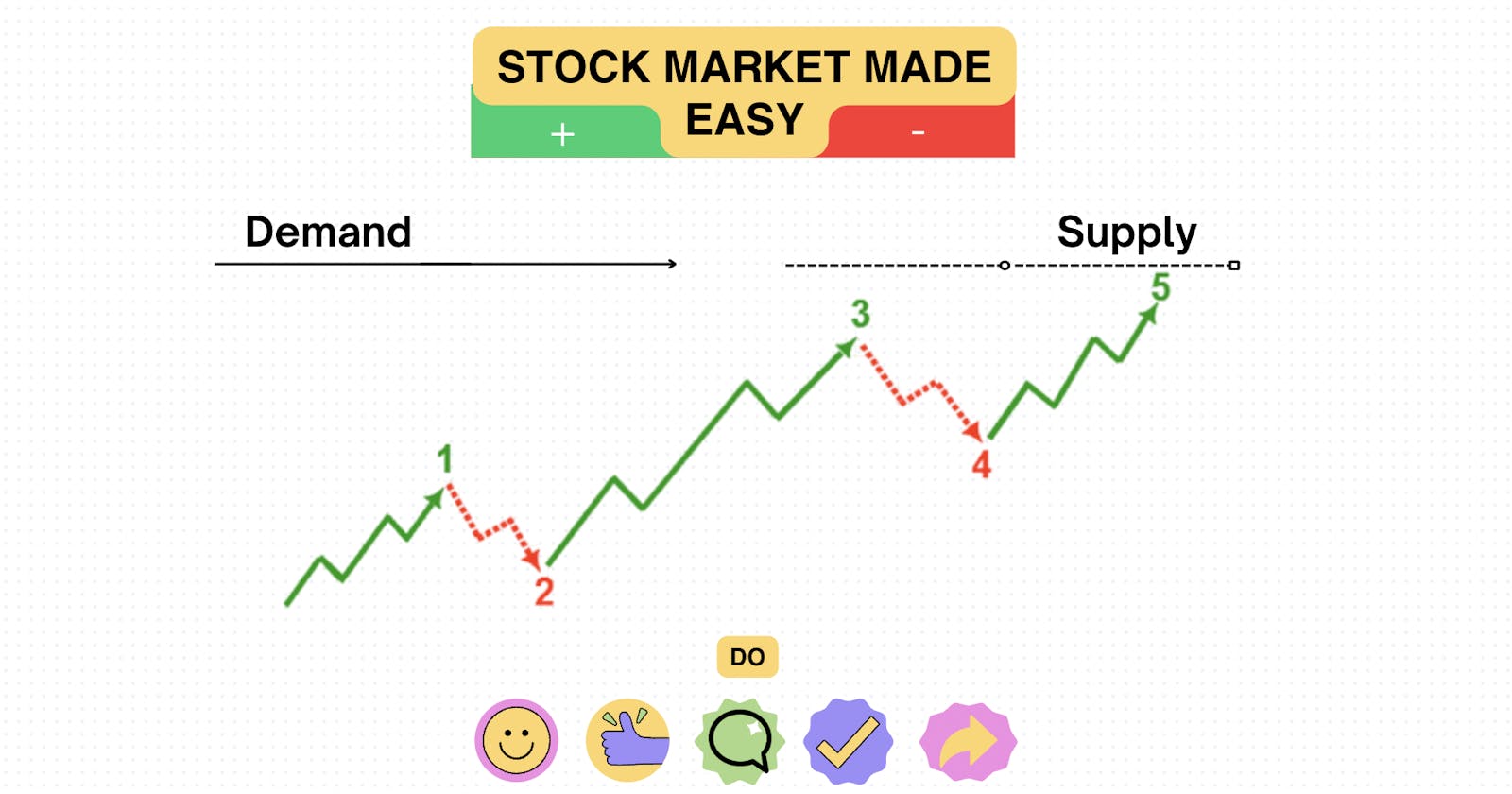

The psychology of demand and supply, factors influencing them in stock market - news and events, market manipulations, fear and greed.

Introduction

In this blog, we will explore the fundamental concept of demand and supply in the context of the stock market. We will use a relatable product, fruits, to help illustrate how the interplay between demand and supply affects prices and market dynamics. While the specific details of the fruit market may differ from the stock market, the underlying principles remain the same. So, let's dive in and gain a deeper understanding of this crucial economic concept!

Exploring Demand and Supply in the Fruit Market

Imagine a bustling fruit market where vendors sell a popular fruit called "Delicious Apples." Initially, the supply of Delicious Apples is limited to 10 per day, which matches the existing demand for 10 apples. The price of the apples is fair, as the vendor can fulfil all the orders with the available supply.

Increasing Demand

Over time, the reputation of Delicious Apples grows, and more people start experiencing its wonderful taste. As a result, the demand for Delicious Apples increases beyond the initial 10 apples per day. Let's say the new demand reaches 15 apples per day or even more. Since the supply remains fixed at 10 apples, a situation of excess demand arises.

Adjusting Prices to Balance Supply and Demand

To manage the increased demand, the vendor decides to raise the price of Delicious Apples slightly. By doing so, the vendor aims to allocate the limited supply to those who are willing to pay a higher price, indicating their higher want and willingness to acquire the product. This price adjustment helps regulate the demand and ensures that the vendor can still sell all the available apples.

Decreasing Demand

Now, let's consider a scenario where the season for Delicious Apples comes to an end, resulting in a decline in demand. Despite the decreased demand, the vendor's supply remains the same at 10 apples per day. As a consequence, some apples may remain unsold, creating surplus stock.

Adjusting Prices to Balance Supply and Demand

To avoid unsold products, the vendor must readjust the prices downward. By reducing the prices, the vendor aims to attract customers who may have lower budgets or are less willing to pay the original price. This adjustment encourages more people to purchase the apples, ensuring that minimal or no apples are left unsold.

Further Insights and Enhancements

While this simple illustration helps grasp the concept of demand and supply, it's essential to note that the stock market operates with much greater complexity. The demand and supply dynamics in the stock market are influenced by various factors, including investor sentiment, market trends, economic indicators, and company performance.

Factors Influencing Demand and Supply Dynamics

News and Events:

-> News and events, such as the release of positive earnings reports or major product launches, can have a significant impact on the demand and supply dynamics of a stock.

Positive news tends to generate optimism and increased interest in a company, leading to higher demand for its shares. Conversely, negative news can create uncertainty and decrease demand, causing the stock price to fall.

Market Manipulation:

-> A pump and dump scheme is a form of market manipulation where fraudsters artificially inflate the price of a stock by spreading false or misleading information to create a sense of high demand.

Once the stock price has been pumped up, the fraudsters sell their shares at the higher prices, generating significant profits. After they have sold their shares, they stop promoting the stock, causing the price to fall. This leaves other unsuspecting investors holding overvalued shares (stocks with price more than their fair price) that eventually lose their value.

During the pumping phase, the fraudsters create artificial demand to sell their shares at higher prices before the stock crashes. They might use social media, online forums, or spam emails to spread positive news, exaggerated claims, or fake endorsements about the company's prospects. These tactics aim to influence unsuspecting investors to buy the stock, driving up the demand and price.

Understanding Market Psychology:

The behaviour of market participants is strongly influenced by psychological factors.

Herd Mentality:

-> Investors often exhibit herd mentality, where they follow the actions of the majority without conducting independent analysis. This behaviour can lead to exaggerated movements in stock prices as investors rush to buy or sell based on others' actions rather than careful evaluation.

Fear and Greed:

-> Fear and greed play a crucial role in market psychology. Fear-driven selling can be triggered by negative news, economic uncertainties, or market downturns. On the other hand, greed can drive investors to buy excessively during periods of optimism, potentially causing overvaluation of stocks. To understand it better...

FOMO (Fear of Missing Out):

-> FOMO refers to the fear that investors experience when they believe they might miss out on a potentially profitable investment opportunity. When investors see others profiting from a particular stock, they may feel compelled to jump on the bandwagon to avoid missing out on potential profit. This can drive up demand and increase stock prices.

The Influence of FOMO on Investor Behavior:

Rush to Buy: Investors experiencing FOMO may feel compelled to buy a stock without conducting thorough research or considering its intrinsic value. This can lead to inflated prices and potential overvaluation.

Increased Volatility: FOMO-driven buying can contribute to increased market volatility (volatility - price increase/decrease rapidly and randomly) as prices fluctuate rapidly due to heightened demand.

Emotional Decision-Making: FOMO can lead to impulsive and emotionally driven investment decisions, which may not align with a long-term investment strategy.

Panic Selling and Its Effects:

-> Panic selling occurs when a large number of investors, driven by fear and a sense of urgency, sell their shares rapidly, resulting in a significant decline in stock prices. Some factors that can trigger panic selling include:

Market Crashes: Steep declines in overall market indices can trigger panic selling as investors fear further losses and rush to exit their positions.

Global Economic Turmoil: Global economic crises or geopolitical events can create widespread panic and lead to mass selling across various stocks and sectors.

The Impact of Panic Selling: Panic selling can have far-reaching consequences,

Market Volatility: Panic selling increases market volatility as sharp price declines trigger further selling, creating a vicious cycle.

Undervaluation: When panic selling drives prices below their intrinsic value, it presents opportunities for value investors to enter the market and potentially benefit from undervalued stocks.

Long-Term Market Stability: While panic selling can cause short-term disruptions, markets have historically shown resilience and recovered over time as rational investors recognize opportunities amidst the chaos.

Conclusion

Understanding the various factors that influence demand and supply dynamics in the stock market, including news and events, market manipulation, market psychology, FOMO buying and panic selling, is essential for investors.

By being aware of these factors, we can make more informed investment decisions, recognize market opportunities, and navigate through volatile periods.

Remember, the stock market is a complex and dynamic system influenced by a multitude of factors. Continuously educating oneself, conducting thorough research, and seeking guidance from financial professionals can contribute to better investment outcomes.

[Disclaimer: The information provided in this blog is for educational purposes only and should not be considered as financial or investment advice. However, please note that the stock market operates on a much larger scale and is influenced by numerous factors. It's crucial to conduct further research and consult financial professionals when making investment decisions.]

Happy Investing!

For more such blogs comment your views and follow.